- How to Create a Family Budget

- How to budget

- Be more money savvy

- How to make a budget

- 1 Get organised and take your time

- 2 Add up your income

- 3 Calculate your essential spending

- 4 Review your disposable income

- 5 Draw up a budget you can stick to

- Top tips for sticking to your budget

- 1 Cut the cost of your debts

- 2 Haggle or shop around to cut your bills

- 3 Be brutal with your leisure spending

- 4 Generate extra cash where you can

- 5 Separate your cash into different pots or accounts

- 6 See all your accounts in one place

- 7 Regularly reassess your budget

- Get debt help if your budget won’t add up

- Related articles

- 11 tips to save on the cost of your subscriptions

- Cost of living crisis: majority of households fear for economy’s future

- 12 cheap and free things to do over October half term

- Six ways to save money on toilet paper

- Bus fares capped at £2 – how else can you save on transport in 2023

- 36 Birthday Freebies and Discounts

- One in seven families miss an essential payment in a single month

- 20 ways to save money on your household bills and living costs in 2023

- Which supermarket offers the best Christmas savings scheme

- Which shops offer the best value for money on lunchtime meal deals

- Where can you buy the cheapest school uniform

- Cost of living crisis: 8 million households on financial cliff edge

- Cheap and free things to do over the summer holidays

- 1. Explore local parks and nature trails

- 2. Have a family game night

- 3. Visit museums and art galleries

- 4. Organize a neighborhood scavenger hunt

- 5. Attend free community events

- 6. Set up a DIY photo shoot

- 7. Have a picnic in the park

- 8. Explore free or discounted local attractions

- Which finds 13 million households missed a bill payment in a single month

- 11 Ways to Save Money on Festivals

- 7 tips for renters to get out of debt

- 8 ways to save money on travel toiletries this summer

- Return train tickets to be scrapped on some routes will it save you money

- 18 ways to save money as a wedding guest

- 9 Cheap and Free Things to Do During the Easter Holidays

- How to Create a Family Budget

- What Is a Family Budget

- Why Should You Have a Family Budget

- How to Set Up Your Family Budget in 3 Steps

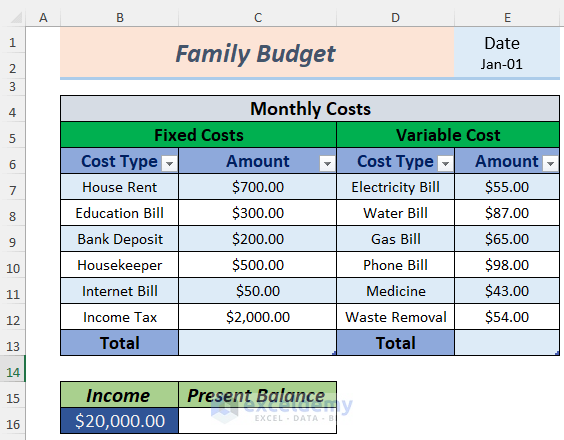

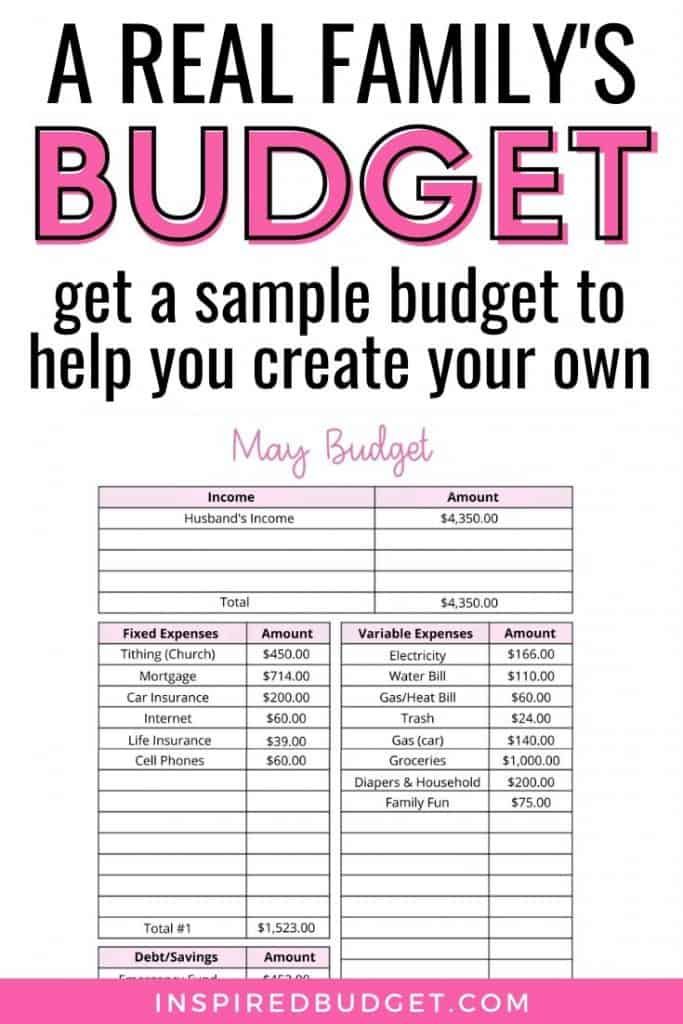

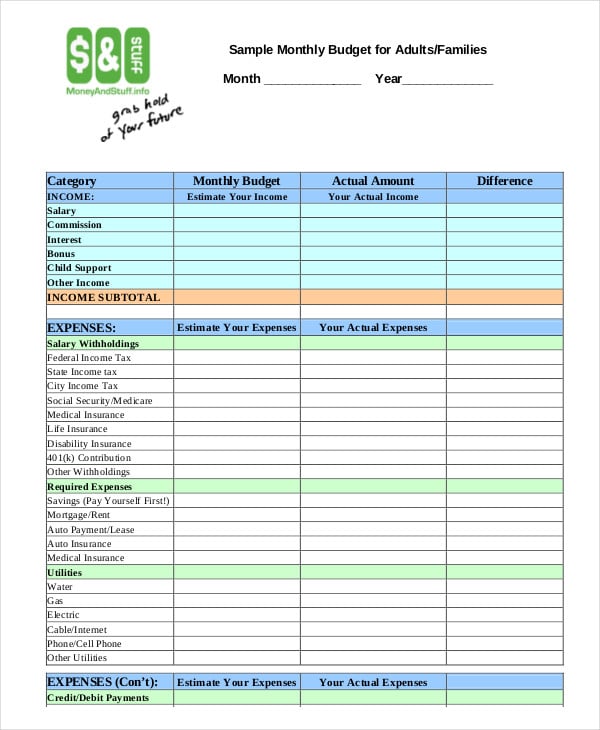

- Budget Step 1: List your income

- Budget Step 2: List your expenses

- Budget Step 3 Subtract your income from your expenses

- Tips for Creating a Family Budget That Works for Everyone

- 1 Select a budgeting method

- 2 Talk about where you are right now

- 3 Discuss the difference in wants and needs

- 4 Communicate with your kids to prioritize spending that connects to them

- 5 Create money goals together

- 6 Track your goal progress

- 7 Have monthly budget meetings

- 8 Make paying off debt a priority

- 9 Track your spending throughout the month

- 10 Adjust your budget when needed

- 11 Have the kids work on commission

- 12 Don’t be afraid to talk about money

- Budgeting Tips for Welcoming a Second Child

- Welcoming a second child will affect your finances but you can keep costs in check by following some simple family budgeting tips

- Related Terms

- Related Topics

- Related Insights

- Related Calculators

- Looking for More

- We hope to see you again soon

- Make an Appointment

- What is a family budget

- Start your family budget with estimates

- Then get a baseline of your expenses

- Now move on to the budgeting

- Try a worksheet or app

- Keep budgeting and communicating

- Budgeting 101: How to Budget Money

- The 8 Best Budget Apps for 2023

- 1. Mint

- 2. YNAB (You Need a Budget)

- 3. Personal Capital

- 4. Tiller Money

- 5. PocketGuard

- 6. EveryDollar

- 7. Goodbudget

- 8. Honeydue

- Manage Your Money

- 21 money-saving tips for parents

- 1 Work out a family budget

- 2 Boost your savings

- 3 Apply for benefits and support

- 4 Stick to the essentials for new babies

- 5 Do your research to avoid overspending

- 6 Save on formula and nappies

- 7 Collect free baby stuff

- 8 Join clubs for discounts

- 9 Look for discount codes and cashback

- 10 Ignore the name tag

- 11 Buy second-hand or borrow

- 12 Tell people what you need

- 13 Keep toys to a minimum

- 14 Cut childcare costs

- 15 Make extra money in your spare time

- 16 Adapt your healthy living activities

- 17 Cut down your food costs

- 18 Reduce household bills

- 19 Get something back when you’re spending

- 20 Plan budget-friendly date nights

- 21 Find cheap parent and baby activities

How to Create a Family Budget

Creating a family budget is essential for anyone who wants to manage their finances effectively. It’s not always easy to make ends meet when you have a family, but with a well-planned budget, you can ensure that you have enough money to accommodate all your needs and even some of your wants. In this article, we will provide you with a step-by-step guide on how to create a budget that works for your family.

First and foremost, it’s important to determine your current financial situation. This includes calculating your current income, expenses, debts, and savings. By doing so, you will have a clear understanding of where your money goes and how much you have left to work with. To make it easier, you can use a budget calculator or a worksheet that includes categories for different expenses like housing, transportation, food, children’s needs, and leisure activities.

Once you have a clear picture of your current financial situation, it’s time to set some financial goals. Ask yourself what you would like to achieve in the near future and in the long run. Do you want to save up for your children’s education? Do you plan on buying a house? Or do you dream of retiring early and traveling the world? Whatever your goals may be, write them down and keep them in mind when creating your budget.

Next, it’s important to list all your expenses and categorize them. Start with your fixed expenses like rent or mortgage payments, utilities, and insurance. Then, move on to your variable expenses such as groceries, transportation, and entertainment. Be sure to include everything, even the small things like snacks and coffee at your favorite coffee shop. By having a comprehensive list of all your expenses, you can find areas where you can cut back and save.

Once you’ve listed all your expenses, compare them to your income. Are you spending more than you earn? If so, it’s time to make some adjustments. Look for areas in your budget where you can reduce spending. For example, you can try cooking at home more often instead of going out to restaurants, or find alternative and more affordable ways to entertain your children. Small changes can make a big difference in the long run.

When creating a family budget, it’s also important to consider unexpected expenses that may arise. These can include medical bills, car repairs, or even celebrations like birthdays and holidays. Set aside a portion of your income towards an emergency fund or create separate “pots” for different expenses. This way, you are prepared for any surprises that may come your way without disrupting your budget.

Lastly, it’s crucial to track your spending and regularly monitor your budget. This will help you stay motivated and accountable. Keep all your receipts and regularly update your budget worksheet or use a budgeting app to keep track of your expenses. By checking your progress regularly, you can identify any areas where you may need to make adjustments and stay on track towards achieving your financial goals.

Creating and sticking to a family budget can be challenging, but with the right mindset and discipline, it’s definitely achievable. By following the steps outlined in this article, you can take control of your finances and work towards a financially secure future for your family.

How to budget

Budgeting is an essential skill for every family, regardless of their income level. It allows you to track your expenses, manage your savings, and ensure that you are living within your means. Here are some steps to help you create a family budget:

- Define your financial goals: Before diving into the numbers, it’s important to identify your financial goals. Do you want to pay off debt, save for a vacation, or buy a new car? By setting clear goals, you can prioritize your spending accordingly.

- Gather all your financial information: To get an accurate picture of your finances, gather all your financial information, including income sources, expenses, and debts.

- Create a monthly budget: Start by listing all your monthly income sources. Then, subtract your fixed expenses, such as rent or mortgage, utilities, and transportation costs. Next, allocate a certain amount for variable expenses like groceries, entertainment, and clothing.

- Track your spending: While sticking to a budget, it’s crucial to track your spending. Keep receipts, use a budgeting app, or write down your expenses in a notebook. This will help you identify areas where you can cut back or save.

- Shop smart: Looking for deals and comparing prices can save you a lot of money. Use websites or apps to find the cheapest prices at supermarkets or compare prices before making a purchase.

- Avoid impulse buying: Before making a purchase, ask yourself if it’s a necessity or a want. If it’s not essential, consider waiting for a few days before deciding to buy it. This will prevent impulse buying and help you make more informed decisions.

- Save for unexpected expenses: It’s important to set aside some money each month for unforeseen expenses. Create an emergency fund that can cover at least three to six months’ worth of living expenses.

- Review and adjust: Regularly review your budget to see if you are staying on track. Adjust your budget as necessary to accommodate changes in your income, expenses, or financial goals.

By following these steps, you can create a budget that works for your family and helps you achieve your financial goals. Remember, budgeting requires discipline and commitment, but the rewards are well worth it.

Be more money savvy

When it comes to managing your family budget, being money savvy can make a huge difference in your financial situation. By adopting certain strategies and making smarter choices, you can stretch your funds further and ensure that your family’s needs are met. Here are some tips to help you become more money savvy:

1. Shop smart: Take the time to research prices and compare deals before making any purchases. Look for discounts and promotions, and consider buying in bulk for commonly used items. By being a savvy shopper, you can save a significant amount of money over time.

2. Start budgeting: If you haven’t already, it’s important to start creating a budget for your family. Begin by listing all your income sources and existing expenses. Then, allocate funds to different categories such as food, transportation, utilities, and entertainment. This will help you gain better control over your finances and identify areas where you can cut costs.

3. Use a budget planner: Utilize a budget planner tool or app to help you organize your finances. These tools can provide a clear overview of your spending and help you track your progress towards financial goals. It’s a useful way to stay accountable and make sure you’re staying on track with your budget.

4. Be mindful of transportation costs: Transportation expenses can easily add up, so it’s important to find ways to minimize them. Consider carpooling, using public transport, or even cycling or walking for short distances. By making small changes to your transport habits, you can save a significant amount of money throughout the year.

5. Identify entertainment alternatives: Instead of relying solely on costly leisure activities, look for free or low-cost alternatives. Take advantage of local parks, community centers, or free events in your area. You can also explore hobbies that don’t require much spending, such as reading, hiking, or gardening.

6. Plan and save for special occasions: It’s essential to plan and save for special occasions in advance, rather than relying on credit cards or dipping into your regular budget. Whether it’s a family vacation, wedding, or holiday celebration, setting aside money specifically for these events will ensure that you’re prepared and won’t face an unexpected financial burden.

7. Check your financial statements: Regularly review your bank statements and credit card statements to ensure they’re accurate. Sometimes, errors or fraudulent charges can go unnoticed, leading to unnecessary expenses. By checking your statements, you can identify any discrepancies and take action accordingly.

8. Make use of discounts and offers: Take advantage of discounts and offers whenever possible. Many providers offer special deals for families, so be sure to inquire and make the most of these opportunities. Whether it’s discounted rates for sports activities or reduced prices for family meals, these savings can add up over time.

9. Avoid impulsive buying: It’s easy to get caught up in the excitement of shopping, but it’s important to resist impulsive purchases. Take some time before making a buying decision and ask yourself if the item is truly necessary. By sticking to your predefined budget and avoiding unnecessary purchases, you can save a substantial amount of money.

10. Grow your emergency fund: Life is full of unexpected events, so it’s crucial to have an emergency fund in place. Set aside a portion of your income each month to build this fund gradually. This will provide you with peace of mind and a financial safety net for any unforeseen circumstances that may arise.

Being money savvy is all about making informed choices and being mindful of your spending habits. By implementing these tips, you can effectively manage your family budget and achieve financial stability.

How to make a budget

Creating a budget is an essential step towards managing your family’s finances effectively. It allows you to track your income and expenses, save for the future, and achieve your financial goals. By following a few simple steps, you can create a budget that reflects your family’s needs and helps you stay on track with your finances.

Step 1: Determine your income and expenses

The first step in creating a budget is to determine your household’s income and expenses. Make a list of all the sources of income, including salaries, investments, and any other additional sources. Then, list all the monthly expenses, including bills, mortgage or rent, groceries, transportation costs, and any other regular expenses you have.

Step 2: Set financial goals

Next, set financial goals for your family. Determine what you want to achieve in the short term and long term. It could be anything from saving for a family vacation, paying off debts, or investing for retirement. Having specific financial goals will help you prioritize your spending and adjust your budget accordingly.

Step 3: Track your spending

To create an accurate budget, it’s important to track your spending. Keep all your receipts, use online banking tools, or use budgeting apps to track where your money is going. This will give you insights into your spending habits and will help you identify areas where you can cut back or adjust your expenses.

Step 4: Categorize your expenses

Categorize your expenses into different categories such as housing, transportation, groceries, entertainment, and savings. This will give you a clear picture of where your money is going and help you notice any areas where you may be overspending.

Step 5: Create a budget plan

Using the information gathered, create a budget plan that outlines how much money you will allocate to each category and how much you will save. Be realistic and adjust your budget as needed, considering your income and financial goals. Keep track of your progress and make adjustments as your financial situation changes.

Step 6: Stick to your budget

Sticking to your budget is crucial for its success. Take advantage of tools like budgeting apps or spreadsheets to help you monitor your spending and keep you accountable. Make sure to stay disciplined and avoid unnecessary purchases that can derail your budgeting efforts.

Step 7: Review and adjust

Regularly review your budget to ensure its effectiveness. Check your progress towards your financial goals and make any necessary adjustments. Life circumstances can change, and your budget should adapt to them. By checking and adjusting your budget regularly, you’ll be able to stay on top of your financial situation and make necessary changes when needed.

Remember, creating and sticking to a budget requires discipline and commitment. It may initially feel a little awkward, but over time it will become a natural process that helps you achieve financial stability and peace of mind for your family.

1 Get organised and take your time

When it comes to creating a family budget, the key is to get organised and take your time. This means carefully planning and considering all the necessary expenses and savings goals. It can be a daunting task at first, but with a little bit of effort and patience, you can create a budget that works for your family.

One of the first things you’ll want to do is take a look at your current financial situation. This means gathering all of your financial documents, such as bank statements, credit card statements, and any other relevant paperwork. Take note of your income, expenses, and any debt or investments you may have.

Next, it’s important to track your spending and make a plan. Keep a nappy on your spending habits for a period of time, such as a few months, and take notice of where your money is going. This can help you identify any areas where you may be overspending and where you can make adjustments.

Once you have a clear idea of your income and expenses, it’s time to start planning your budget. You’ll want to allocate funds for essential expenses like housing, utilities, transportation, food, and healthcare. It’s also important to reserve some money for savings and investments.

Stick to your budget by setting realistic goals and adjusting your spending as needed. It’s important to remember that creating a budget is a dynamic process, and it may take some time to find the right balance for your family.

If you’re feeling overwhelmed or need some guidance, consider using a budgeting service or working with a certified financial planner. They can help you analyze your financial situation and develop a budget that meets your family’s needs.

Don’t forget to look for ways to cut costs and save money. For example, you can trade off expensive activities or products for cheaper alternatives. You can also bulk buy certain items, look for discounts or sales, and shop at discount or second-hand stores.

Another thing to consider is your regular bills, such as your mortgage or rent, utilities, and insurance policies. Take notice of any fixed costs and see if there are any ways to reduce them, such as switching to a cheaper provider or negotiating a better deal.

When planning your budget, it’s also important to accommodate for any upcoming major expenses or financial goals. For example, if you’re expecting a new baby, you’ll need to budget for expenses like prenatal care, childbirth, and childcare. If you’re planning a wedding or a big trip, you’ll need to set aside money for those as well.

Remember that budgeting is not a one-time activity. It’s an ongoing process that requires regular review and adjustments. Make it a habit to review your budget every month or so to make sure you’re staying on track and making progress towards your financial goals.

2 Add up your income

Once you have a clear understanding of your expenses, it’s time to calculate your income. Understanding your total income will help you determine how much you can allocate towards different categories in your family budget.

Start by gathering all your income statements, such as pay stubs, bank statements, and any other documents that provide information on your household’s income. Make sure to include income from all sources, including salaries, wages, bonuses, investments, and any other sources of income.

When adding up your income, keep in mind that each household member’s income should be included if they contribute financially. Whether it’s a full-time job or a part-time gig, every dollar counts.

However, it’s essential to differentiate between guaranteed income and variable income. Guaranteed income, such as salaries or pensions, is regular and stable and can be used to cover fixed expenses. Variable income, on the other hand, may fluctuate depending on factors such as commissions or tips, and should be allocated towards discretionary expenses or used to build savings.

Also, consider any income from government benefits, rental properties, or side businesses that you may have. Every source of income is valuable and should be included in your calculation.

If you receive child support or spousal support, make sure to include it as well. Child support can be an essential source of income, especially for single-parent households.

Remember, tracking your income accurately is vital for an effective family budget. Make sure to list all sources of income, write down the amounts, and calculate the total. A spreadsheet or a budgeting app can be helpful in performing these calculations.

It’s worth noting that some sources of income may come with tax implications or deductions, so be sure to read up on any tax laws that may apply to your situation.

| Income Source | Amount |

|---|---|

| Salaries and Wages | $ |

| Investments | $ |

| Side Businesses | $ |

| Government Benefits | $ |

| Rental Income | $ |

| Child or Spousal Support | $ |

| Other | $ |

| Total Income | $ |

Once you have your total income calculated, you can move on to the next step in creating your family budget: categorizing and allocating your income to different expense categories.

3 Calculate your essential spending

When it comes to creating a family budget, it’s important to get a handle on your essential spending. These are the expenses that you cannot avoid and are necessary for your family’s daily life. By calculating your essential spending, you can better control your finances and make informed choices about where your money goes.

Start by looking at your previous monthly expenses to see how much you have been spending on essential items. This can include things like rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, and any necessary medical expenses. These are the points at which your money went previously, and it’s important to keep in mind that they are non-negotiable expenses.

It’s also worth considering any costs that come up regularly but may not be monthly. For example, if you have children, you may need to budget for birthday gifts or expenses related to their extracurricular activities like sports or music lessons. If you’re a car owner, you need to factor in the cost of routine maintenance and repairs. By considering these expenses, you can better meet the needs of your family without being caught off guard by their costs.

If you find it challenging to determine how much to allocate for certain expenses, you can seek guidance from a financial advisor or use online tools. Websites like Confused.com offer personalised advice and guidance to help you create a budget that works for your family. They might provide you with a better understanding of the average costs for essentials like rent, utilities, and groceries, based on your location and the size of your family.

Don’t forget to take into account any additional expenses that may not fall into the traditional categories but are still necessary for your family’s well-being. This could include things like healthcare costs, insurance policies, or even a rainy day fund. Being prepared for unexpected expenses can help you stick to your budget without worry.

Remember, the goal is to balance your essential spending with your overall financial goals. Whatever your priorities may be, it’s important to ensure that your essential expenses are taken care of without compromising your ability to achieve your long-term objectives.

In conclusion, calculating your essential spending is a crucial step in creating a family budget. By understanding where your money goes and making informed choices about your expenses, you can take control of your finances and work towards a more secure financial future.

4 Review your disposable income

After setting up a budget, it’s important to regularly review your disposable income. This is the amount of money you have left after paying for all your necessary expenses such as rent, utilities, and groceries. Reviewing your disposable income will give you a clear picture of how much money you have available for other expenses or saving.

To review your disposable income, start by looking at your income and subtracting all your fixed expenses. These can include mortgage or rent payments, car loans, insurance premiums, and other monthly bills. Once you have subtracted these expenses from your income, you will have a better idea of how much money is left over.

Next, take a look at your variable expenses. These are expenses that can change from month to month, such as entertainment, dining out, shopping, and travel. It’s important to be realistic when estimating these expenses, as underestimating can lead to overspending.

If you find that your disposable income is limited or negative, it may be necessary to adjust your budget. Look for areas where you can cut back, such as eating out less frequently or finding ways to save on utility bills. Consider joining membership clubs or subscribing to utility-saving websites to get discounts and promotions. Also, be sure to take advantage of reusable items and buy from second-hand sites to save money on clothes, furniture, and other items.

Don’t forget to review your insurance policies and utility providers regularly. Many companies offer discounts or promotions to existing customers, so it’s worth looking into these options. You can also consider bundling your insurance policies with one provider to potentially save on premiums. If you are trading in your car or buying a new one, check different insurance providers to see if there are better rates available.

When reviewing your disposable income, it’s important to also consider future expenses. If you have plans for a large purchase, such as a new car or a family vacation, start setting aside money each month towards that goal. Additionally, think about long-term financial goals like saving for retirement. Look into different options, such as pensions or annuities, to see which would work better for you.

If you have recently had a baby or are planning to have one, don’t forget to factor in the costs of birth and childcare. Breastfeeding can help reduce some expenses, but there are still many costs involved. Be sure to consider these expenses when reviewing your budget.

Finally, stay up-to-date with the latest financial news and learn more about managing your money. There are many websites, apps, and articles that can provide helpful tips and advice. You can also take advantage of free financial lessons and calculators online to help you make informed decisions. Remember, being in control of your money is important for your financial well-being.

5 Draw up a budget you can stick to

Creating a family budget is essential for managing your finances effectively and ensuring that you can meet your financial goals. Here are some key points to consider when drawing up a budget that you can stick to:

1. Assess your income and expenses: Start by documenting all sources of income, including salaries, wages, and any other income you receive. Next, track your expenses, including rent or mortgage payments, utilities, groceries, transportation, and other regular expenditures. This will give you a clear understanding of your financial situation.

2. Set financial goals: Determine what you want to achieve with your budget. Are you saving for a home, a vacation, or your children’s education? Setting financial goals will help guide your spending decisions and keep you on track.

3. Prioritize your spending: Identify your essential expenses, such as food, shelter, utilities, and healthcare. Allocate a specific amount of your income for these necessities. Then, you can determine how much you can afford to allocate towards discretionary spending, such as entertainment or dining out.

4. Trim unnecessary expenses: Look for areas where you can cut back on your spending. This might involve reducing dining out, finding cheaper alternatives for certain products or services, or renegotiating contracts or subscriptions. Cutting unnecessary expenses will free up more money to put towards your financial goals.

5. Create a realistic budget: Once you have a clear understanding of your income and expenses, set realistic budget categories and allocate specific amounts for each. Be realistic about your financial limitations and avoid overcommitting funds to any one category. Your budget should be flexible enough to adapt to unexpected expenses or changes in income.

Remember, sticking to a budget takes discipline and commitment. Monitor your spending regularly to ensure you’re staying on track. Adjust your budget as needed when your financial situation changes. With time and practice, you’ll become more proficient at managing your family’s finances and achieve your financial goals.

Top tips for sticking to your budget

Sticking to a budget can be challenging, but with the right strategies in place, it is possible to stay on track and manage your finances effectively. Here are some top tips to help you stick to your budget:

- Track your spending: Make sure to keep a record of all your expenses, including even the smallest amounts. This will give you a clear picture of where your money is going and enable you to make necessary adjustments.

- Create a realistic budget: Set a budget that reflects your income and expenses accurately. Avoid being overly optimistic about your income and underestimate your expenses. Be honest with yourself and be realistic about what you can afford.

- Prioritize your expenses: Determine your needs versus your wants. Focus on essential expenses such as rent, utilities, and groceries. Cut back on discretionary spending and prioritize saving for emergencies.

- Plan your meals: Cooking at home is generally more cost-effective than eating out. Plan your meals in advance, make a list before shopping, and stick to it to avoid impulsive purchases. Consider batch cooking and freezing meals for convenience and to save money.

- Shop smart: Take advantage of sales, discounts, and coupons to stretch your budget. Compare prices, shop around, and consider buying second-hand goods when possible. Avoid impulse buying and wait a day or two before making non-essential purchases to prevent buyer’s remorse.

- Limit transportation costs: If possible, use alternative modes of transport like walking, biking, or carpooling to reduce fuel and transportation expenses. Plan your errands efficiently to minimize travel and save on both time and money.

- Review your insurance policies: Regularly check your insurance policies to ensure you have the appropriate coverage at the best rates. Look for better deals and compare quotes from different providers. Consider bundling your insurance policies for potential discounts.

- Stay informed: Keep up-to-date with personal finance tips, deals, and money-saving advice by subscribing to newsletters, following financial experts, or joining online communities. Learning from others can provide valuable insights to help you make informed financial decisions.

- Stay motivated: Celebrate your progress and set small goals to keep you motivated. Reward yourself when you achieve milestones or savings targets. Remember that sticking to a budget is a long-term commitment and staying motivated is key to its success.

By following these top tips, you can increase your chances of sticking to your budget and achieving your financial goals. Remember, it’s okay to make adjustments along the way as your circumstances and priorities change. The important thing is to regularly review your budget, track your expenses, and make conscious choices about how you spend your money.

1 Cut the cost of your debts

If you’re struggling to make ends meet and find yourself drowning in debt, it’s important to take action to cut down on your expenses. By reducing your debts, you can free up more money each month to put towards your family budget.

Here are some strategies you can use to cut the cost of your debts:

|

|

By taking steps to cut the cost of your debts, you can free up more money in your budget to put towards other important expenses, such as household essentials, savings, or family activities.

2 Haggle or shop around to cut your bills

One of the most important things for couples to do when creating a family budget is to haggle or shop around in order to cut their bills. This step is crucial for securing a brighter financial future for your family.

Don’t shy away from exploring different options and comparing prices. Loyalty to a specific brand or company may not always be the best choice for your budget. Instead, simply shop around and find the best deals. Grip tightly on every penny and take advantage of any savings opportunities that come your way.

If you’re already tight on your monthly budget, start by reviewing your existing bills and household expenses. Often, you may realize that you’re paying more than necessary for certain goods or services. This exercise can be an eye-opener and help you cut costs significantly.

Arranging family vacations and outings ahead of time is another way to save money. By booking in advance, you may be able to take advantage of lower prices and special offers. Your savings can then be allocated to other areas of your budget.

When it comes to bills, it’s important to communicate with your service providers. Registering on websites or contacting a customer representative can often lead to discounts or lower rates. This is true for various areas of your budget, such as utilities, insurance, and telecommunications.

Don’t overlook the potential savings that come from purchasing second-hand goods. There are many online sites and local stores that specialize in selling gently used items. This can be particularly useful when it comes to children’s items, as they quickly outgrow toys and clothes. By shopping second-hand, you can save a significant amount of money while still providing for your children’s needs.

It’s also a good idea to encourage your children, especially the teens, to be mindful of their spending. Teach them the value of money and the importance of shopping around. By involving them in the budgeting process, you can help them develop important financial skills that will serve them well in the future.

Take advantage of available resources and tools to help you create a family budget. Many financial websites offer free budgeting worksheets or personalised budget plans. These can be a great starting point to get a better understanding of your financial situation and set financial goals.

Remember, creating a family budget is a step-by-step process. Start by cutting unnecessary expenses, monitor your earnings and spending regularly, and make adjustments as needed. With time and practice, you will gain full authority over your finances and be able to achieve your family’s financial aspirations.

3 Be brutal with your leisure spending

When creating a family budget, it is important to be honest and realistic about your leisure spending. This means taking a hard look at your current habits and making some tough decisions.

Start by examining your bank statements and credit card bills to get a full picture of where your money is going. You may be surprised to find that a significant portion of your income is being spent on leisure activities.

Take-home a highlighter and go through each statement, marking any expenses related to entertainment, dining out, or hobbies. Once you have an accurate estimate of how much you are spending on leisure, take a step back and ask yourself if these activities are essential to your family’s well-being.

It’s important to distinguish between what you truly enjoy and what you feel pressured to do. Just because your friends are constantly dining out or going to expensive sporting events, doesn’t mean you need to follow suit. Be honest with yourself and your family about what brings you joy and prioritize those activities.

Consider switching to more affordable alternatives or finding ways to earn credits through customer loyalty programs. Take the time to read reviews and compare prices before making a purchase. Websites like Inspopcom and Lifesearch are great resources for finding deals and earning cashback on your purchases.

Don’t be afraid to say no to activities or events that don’t align with your financial goals. Remember that every dollar you spend on non-essentials is money that could be used towards your future, whether it’s paying off debt or saving for a down payment on a mortgage.

If you have older children, get them involved in the budgeting process. Teach them the value of money and let them see the consequences of overspending. This will not only help them develop good financial habits but also strengthen their relationship with money as they grow up.

A great exercise is to create a leisure spending planner. List out all the leisure activities you and your family enjoy, and assign a monthly budget to each. This will help you keep track of how much you are spending and hold yourself accountable.

Remember, it’s not about depriving yourself of fun. It’s about making intentional choices that align with your financial goals. By being brutal with your leisure spending, you’ll free up more money for the things that truly matter to you and your family.

4 Generate extra cash where you can

If you’re looking to stretch your family budget even further, consider generating extra cash where you can. Here are some tips to help you do just that:

1. Take advantage of cashback offers and discounts: Many websites and apps offer cashback or discounts on your purchases. Take advantage of these offers to save some money.

2. Look for ways to cut costs: Analyze your monthly expenses and look for areas where you can cut costs. It could be as simple as canceling a subscription you no longer use or finding a cheaper alternative for certain products or services.

3. Find ways to generate extra income: Consider taking on a side hustle or finding ways to generate extra income. This could be through freelance work, selling unwanted items, or offering services in your community.

4. Use money-saving apps and tools: There are many apps and tools available that can help you save money and track your expenses. Look for ones that are user-friendly and cater to your specific needs.

5. Take advantage of discounts and offers: Look for discounts and offers on groceries, clothing, and other essentials. Many stores offer loyalty programs or special deals that can help you save money.

6. Consider switching providers: Shop around for better deals on services such as insurance, internet, and utilities. Switching providers could potentially save you a significant amount of money.

7. Utilize reusable items: Instead of constantly buying disposable items, invest in reusable alternatives. This not only saves money but also helps reduce waste.

8. Communicate and negotiate: Don’t be afraid to negotiate with service providers or communicate your needs. They may be able to offer discounts or better terms if you ask.

By following these tips and being savvy with your finances, you can generate extra cash and stick to your family budget. Remember, every little bit helps and progress is progress, no matter how small.

5 Separate your cash into different pots or accounts

One effective way to manage your family budget is to separate your cash into different pots or accounts. By doing this, you can allocate specific funds for different expenses or savings goals, making it easier to track your spending and stay on budget. Here are some steps to help you get started on this approach:

- Create separate accounts or pots for different expenses or savings goals. For example, you can have a dedicated account for bills and utilities, another one for groceries and everyday expenses, and another one for savings and investments.

- Decide how much money you want to allocate to each pot or account. This can be based on your monthly income, taking into consideration all the necessary expenses and savings goals.

- Set up automatic transfers or direct deposits to allocate the designated amount of money to each account or pot. This way, you can ensure that the money is consistently being distributed to the right places.

- Keep track of your spending and ensure that you stay within the allocated amounts for each pot or account. This may require regular monitoring of your bank statements or using budgeting apps or tools to help you track your expenses.

- Make adjustments as needed. If you find that you have been consistently overspending in one area, you may need to reevaluate your allocations and make adjustments to ensure that you are effectively managing your family budget.

Separating your cash into different pots or accounts can help you build better financial habits and provide a clearer picture of your spending and saving patterns. It can also help you prioritize your financial goals and ensure that you have enough funds for the important things like childcare, savings, and emergencies.

It’s important to note that while this approach can be helpful, it may not be suitable for everyone. Some individuals may prefer to keep all their funds in one account and utilize other budgeting methods. You should choose a budgeting approach that works best for your specific financial situation and goals.

6 See all your accounts in one place

Managing your family’s finances can be a daunting task, especially when you have multiple accounts to keep track of. But with the help of technology, it’s now easier than ever to see all your accounts in one place.

There are various apps and websites available that allow you to link all your accounts, including bank accounts, credit cards, loans, and even investment portfolios. By doing so, you can have a comprehensive view of your family’s financial activity.

Having all your accounts in one place means that you can keep track of your income, expenses, and savings without having to log in to multiple platforms. You can also monitor your progress towards your financial goals, such as saving for a vacation or paying off debts.

One such app that you can use is called “Money Manager,” which includes a feature called “Account Aggregation.” This feature allows you to link all your accounts within the app, so you can see them all at a glance. It gives you a real-time view of your finances, including your balances, transactions, and payments.

With this kind of app, you can easily keep track of your family’s spending habits. For example, you can see how much money is being spent on groceries, restaurant fares, or school fees. This information can help you make better financial decisions and find ways to save more money.

Furthermore, by having all your accounts in one place, you can easily communicate with your family about your financial goals and progress. You can share this information using the app’s built-in communication tools, such as chat or email. This promotes transparency and helps everyone in the family stay on the same page.

Another advantage of seeing all your accounts in one place is that it allows you to see the big picture. You can analyze your spending patterns and identify areas where you can cut down on expenses. Perhaps you’re spending too much on entertainment or unnecessary goods. By seeing everything in one place, you can make informed decisions about where to cut back.

Overall, having all your accounts in one place can simplify the task of managing your family’s finances. It saves you time and effort, and it allows you to stay organized and proactive. So, don’t wait any longer; start using an account aggregation app today and see the difference it can make in your financial life!

7 Regularly reassess your budget

Creating a family budget is an important step towards managing and prioritizing your financial well-being. However, it’s not a one-time task. It’s necessary to regularly reassess your budget to ensure it still aligns with your financial goals and current circumstances.

Here are some reasons why regularly reassessing your budget is crucial:

- Life changes: Life can be unpredictable, and your financial situation may change over time. Regularly reassessing your budget allows you to adapt and make necessary adjustments to accommodate new expenses or changes in income.

- Changing needs and priorities: As your family grows and evolves, so do your needs and priorities. Reassessing your budget helps you stay on track and ensure you’re allocating funds to the areas that matter most to you and your family.

- Identifying unnecessary expenses: As time goes on, certain expenses may become obsolete or less important. By reviewing your budget regularly, you can identify and eliminate any unnecessary expenses, freeing up more funds for the things that truly matter.

- Better financial management: Regularly reassessing your budget allows you to better manage your finances. It gives you a clear picture of where your money is going and helps you identify areas where you can cut back or save more effectively.

- Take advantage of money-saving opportunities: By reassessing your budget, you may discover new ways to save money. You can explore options like switching to cheaper communication providers, finding discounted rates for insurance or utilities, or even negotiating better deals with service providers.

- Updating financial goals: Your financial goals may change over time, and it’s important to align your budget with those goals. Regular reassessment ensures that your budget reflects your current goals so you can work towards them effectively.

- Financial peace of mind: Regularly reassessing your budget provides you with financial peace of mind. It helps you stay on top of your expenses, manage your debt, and make smarter financial decisions.

Remember, a budget is not set in stone. It’s a flexible tool that can be adapted as needed. By regularly reassessing your budget, you can ensure that it remains a useful and effective tool for managing your family’s finances.

Get debt help if your budget won’t add up

If you find that your family budget just doesn’t seem to add up, and you’re struggling with debt, it’s important to seek help as soon as possible. Ignoring the problem will only make it worse, and you could find yourself in a difficult financial situation.

One of the first steps you can take is to review your expenses and eliminate any unnecessary goods or expenses. Cut back on discretionary spending and prioritize your needs over wants. It may be hard to let go of expensive habits or indulgences, but it’s important to stay focused on your financial goals.

If your mortgage or rent is taking up a significant portion of your budget, consider downsizing or finding a more affordable place to live. You may also want to explore the option of refinancing your mortgage to lower your monthly payments.

If you have existing debt, such as credit card balances or loans, it’s essential to tackle it head-on. Consider consolidating your debts into a single loan with a lower interest rate, or negotiate with your lenders for better terms. Debt consolidation can help you simplify your monthly payments and save money on interest.

If you have a freelance or part-time job, consider increasing your earnings by taking on additional work. Look for ways to monetize your skills or hobbies, such as offering freelance services or starting a small business. Every extra dollar you earn can go towards paying off your debts and improving your financial situation.

Another way to free up some funds is to negotiate utility bills, cable and internet packages, or insurance premiums. Many providers are willing to lower rates if you show them that you’re shopping around for better deals. Use this opportunity to review all your expenses and identify areas where you can save.

When it comes to managing your budget, it’s essential to set aside funds for unforeseen expenses. Create an emergency fund to cover unexpected costs, such as car repairs or medical bills. This way, you won’t have to rely on credit cards or loans when an emergency arises.

You should also track your spending and be accountable for your purchases. Keep a record of all your expenses and categorize them into different groups to identify where your money is going. This exercise will help you identify areas where you can cut back and find ways to save.

If you’re struggling with debt and don’t know where to turn, don’t hesitate to seek professional help. There are many debt counseling services available that can provide guidance and support. They can help you create a debt repayment plan, negotiate with creditors, and offer financial education to prevent future debt.

Remember, managing debt and creating a budget takes time and effort. It may not happen overnight, but with persistence and determination, you can get your finances back on track.

Fill out the form to get free newsletter filled with financial insights, opinions, and tips that could help you get your budget on track and start saving for the future, while still being able to enjoy some of life’s little pleasures.

Sign up for our free newsletter today and start taking control of your financial future!

Related articles

Looking for inspo on how to manage your family budget? Check out these articles for more tips and ideas:

1. How to Save Money on Your Wedding

Planning a wedding can be expensive, but there are ways to cut costs without sacrificing the day of your dreams. This article provides tips for finding budget-friendly venues, negotiating with vendors, and DIYing your decorations. Don’t let the price tag of your big day derail your budget – read this article and say “I do” to savings!

2. How to Get the Best Deals at Supermarkets

When it comes to grocery shopping, a little planning and strategy can go a long way. This article offers practical tips for finding the best sales, utilizing coupons, and shopping smart to save money on your regular trips to the supermarket. Discover how to complement your family budget with savvy shopping skills!

3. Five-Step Guide to Buying Second-Hand Items

If you’re looking to save money and reduce waste, buying second-hand items can be a great option. This article walks you through the five-step process of shopping for second-hand goods, from finding reputable sellers to inspecting items for quality. Explore the world of thrifting and take a sustainable step toward a better budget!

4. The Importance of Health Insurance

Healthcare expenses can quickly add up, but having the right insurance coverage can provide financial security. This article explains the benefits of health insurance, how to choose the right plan, and what to consider when it comes to your family’s healthcare needs. Don’t let unexpected medical costs derail your budget – read this article and take charge of your health!

5. How to Track Your Income and Expenses

Keeping a regular record of your income and expenses is essential for effective budgeting. This article introduces various tools and methods for tracking your finances, from mobile apps to traditional pen and paper. Learn how to stay on top of your money-related matters and make informed decisions about your family’s budget!

Note: The insurance provider mentioned in this article is a trademark-owned company and should be sought directly for specific policies and coverage. This article does not offer personalized advice and should not be considered a substitute for professional financial guidance. Seek the advice of a qualified insurance carrier or financial provider for your unique circumstances.

11 tips to save on the cost of your subscriptions

Subscriptions can quickly add up and take a toll on your family budget. By implementing some simple strategies, you can save money and still enjoy the services you love. Here are 11 tips to help you cut down on the cost of your subscriptions:

- Review your subscriptions: Take a close look at every subscription you currently have and determine whether you still use and enjoy each one. Cancel any that are no longer necessary.

- Consider bundled options: Many companies offer bundles that include multiple services for a lower price. Look into whether bundling your subscriptions could save you money.

- Share subscriptions with family and friends: Discuss with your spouse, family members, or close friends whether they would be interested in sharing subscriptions. For example, you could split the cost of a streaming service or a magazine subscription.

- Take advantage of free trials: Before committing to a subscription, take advantage of any free trial periods to determine whether you truly enjoy the service. Be sure to cancel before the trial period ends if you’re not interested in continuing.

- Look for deals and discounts: Keep an eye out for deals and discounts on subscriptions. Websites like Groupon often offer discounted rates for various services.

- Consider alternatives: Instead of subscribing to a service, see if there are free or cheaper alternatives available. For example, instead of a meal delivery service, you could try meal prepping or cooking at home more.

- Utilize cashback websites: Sign up for cashback websites that offer rewards for shopping. You can earn cashback on purchases you make for subscriptions and other essentials.

- Negotiate or haggle: When it comes to certain subscriptions, such as insurance or utility bills, don’t be afraid to negotiate. Call customer service and see if they can offer you a better deal or rate.

- Consider shared subscriptions: If there are subscriptions that you only use occasionally, consider sharing them with friends or family members. For example, you could share a streaming service account and split the cost.

- Keep track of your subscriptions: Make a list of all your active subscriptions and their costs. Set a reminder to review this list every few months to ensure you’re not paying for services you no longer use.

- Be open to alternatives: Sometimes, simply adapting your habits can help you save on subscriptions. For example, instead of buying bottled water, invest in a reusable water bottle.

By following these tips, you can reduce the cost of your subscriptions and free up more money to allocate elsewhere in your family budget. Remember, the goal is to create a budget that works for you and helps you achieve your financial goals.

Cost of living crisis: majority of households fear for economy’s future

As the cost of living continues to rise, the majority of households are growing increasingly concerned about the future of the economy. Balancing a budget, saving money, and making ends meet has become a critical challenge for many families.

Learning to manage multiple expenses is essential for better financial stability. By taking advantage of deals and discounts, households can stretch their budget and maximize their buying power. This means being savvy when shopping for everyday essentials, such as groceries.

Just a few years ago, a gallon of milk might have cost just a few dollars. But today, families may find themselves paying significantly more for this basic staple. Balancing the cost of goods, such as diapers and formula for infants, can be quite challenging as well.

When it comes to planning for the future, many families anticipate the high costs associated with raising children. From education expenses to extracurricular activities, the overall financial burden can be overwhelming. Even something as simple as a family vacation can come with a hefty price tag.

In order to keep up with the rising costs of living, many households are turning to online resources and tools. Websites and apps that help users find the best deals and discounts can be instrumental in managing expenses. Families can also look into joining clubs or loyalty programs that offer savings on everyday purchases.

If you find yourself struggling to meet the demands of a tight budget, expert advice and guidance can be invaluable. Financial experts can provide strategies for saving money, planning for the future, and making smart financial decisions. There are also online calculators and budgeting tools available to help individuals and families track their expenses and set goals.

In a commercial world driven by media and advertising, it is important to distinguish between essentials and wants. Choosing between buying a trendy new gadget or saving for the future can be a difficult decision, but prioritizing financial security should always come first.

By setting aside a small portion of income each month, households can start building an emergency fund or initiate savings for long-term goals. Switching to more affordable providers for services such as insurance or utilities can also make a significant difference in monthly expenses.

It is clear that many households are feeling the pinch of the cost of living crisis. However, with proper planning and budgeting, it is possible to navigate these challenges and work towards a more secure financial future. Remember, the goal is to make the most of your hard-earned money and live a fulfilling life while staying within your means.

12 cheap and free things to do over October half term

If you’re looking for ways to keep the kids entertained during October half term without breaking the bank, we’ve got you covered. Here are 12 cheap and free activities to enjoy with your family:

- Take a trip to a local park or forest for a fun-filled day of outdoor adventure.

- Visit a museum or art gallery in your area. Many offer free entry or special offers during school holidays.

- Have a movie night at home. Pop some popcorn, dim the lights, and enjoy a family-friendly film together.

- Go on a nature scavenger hunt. Create a list of items for the kids to find while exploring the outdoors.

- Organize a family game night. Dust off those board games and spend an evening competing and laughing together.

- Explore your local library. Many have free events and activities for children during school holidays.

- Get creative with arts and crafts. Use materials you already have at home to make homemade decorations or gifts.

- Take advantage of free community events. Check out local websites or social media for information on upcoming festivals or fairs.

- Plan a picnic in the park. Pack some sandwiches and snacks, and enjoy a meal al fresco with your loved ones.

- Visit a nearby beach or lake. Take a leisurely stroll, collect shells, or simply relax and enjoy the scenery.

- Have a DIY spa day at home. Pamper yourselves with homemade face masks, nail painting, and relaxation techniques.

- Set up a family photo booth. Use props and costumes to create memorable pictures you can cherish for years to come.

Remember, having fun doesn’t have to cost a fortune. By being creative and resourceful, you can create lasting memories with your family without breaking the bank. Enjoy your October half term!

Six ways to save money on toilet paper

Toilet paper is a necessary expense for every household, but it doesn’t have to break the bank. Here are six ways to save money on toilet paper:

| 1. Restaurant napkins | If you find yourself in a restaurant and see that they have normal napkins, don’t be shy about grabbing a few extras. These napkins can serve as a cost-effective alternative to buying toilet paper. |

| 2. School supplies | When back-to-school season rolls around, take advantage of the great deals on school supplies. You can often find toilet paper at discounted prices, especially if you stock up during sales or clearance events. |

| 3. Reusable cloths | If you’re really struggling with toilet paper costs, consider investing in reusable cloths. While this option may not be for everyone, it can provide significant savings in the long run. |

| 4. Shop in Cardiff | A study finds that residents of Cardiff spend less on toilet paper compared to other cities in the UK. If you’re based in Cardiff or have the opportunity to shop there, it might be worth taking advantage of the lower prices. |

| 5. Cut down usage | Toilet paper usage adds up quickly, but you can reduce consumption by using fewer sheets per visit. This small change can make a big difference in your overall budget. |

| 6. Compare brands | Don’t be afraid to shop around and compare prices and quality between toilet paper brands. Sometimes cheaper alternatives can offer just as much comfort and durability as premium ones. Doing your research can lead to significant savings. |

By implementing these tips, you can reduce your toilet paper expenses and free up more money for other essential items in your household budget. Remember that every little saving counts, and with smart planning, you can meet your financial goals while still maintaining a good quality of life.

Bus fares capped at £2 – how else can you save on transport in 2023

With bus fares now capped at £2, there are even more opportunities to save on transport in 2023. Whether you’re a family on a tight budget or simply looking to cut down on expenses, here are some tips to help you save on transportation costs:

1. Consider alternative transportation options: Instead of relying solely on buses or trains, explore other modes of transportation such as cycling or walking. Not only will this save you money, but it’s also a great way to stay active and reduce your carbon footprint.

2. Share rides: Carpooling or ride-sharing with friends, neighbors, or colleagues can significantly reduce your transportation expenses. By sharing the cost of fuel and parking, you can save a considerable amount of money over time.

3. Stick to budget-friendly brands: When it comes to purchasing a vehicle, consider opting for a more affordable brand that offers good fuel efficiency. This will not only save you money upfront but also on maintenance and fuel costs in the long run.

4. Plan your trips ahead: By planning your trips and errands in advance, you can avoid unnecessary back-and-forth travel, saving both time and money. Consolidate your errands into one trip to minimize travel expenses.

5. Take advantage of deals and discounts: Keep an eye out for promotional offers, discounts, and loyalty programs offered by transportation companies and providers. By staying informed and taking advantage of these offers, you can save a significant amount of money on tickets and fares.

In addition to these five steps, there are other ways to save on transportation costs. For example, consider walking or cycling for short distances instead of relying on public transportation. If you have a car, keep it properly maintained to ensure optimal fuel efficiency. Embracing a more minimalist lifestyle can also reduce the need for excessive transportation, leading to further savings.

Remember, the key to saving on transportation costs is to identify areas where you can make changes and calculate the potential savings. By making small adjustments and being mindful of your transportation expenses, you can create a family budget that leaves more money in your pocket for the things that are truly important.

36 Birthday Freebies and Discounts

- Get a free meal at your favorite restaurant

- Save on clothing and accessories at various shops

- Enjoy a complimentary dessert at a local bakery

- Receive discounts on movie tickets and entertainment

- Get a free birthday gift from your favorite beauty store

- Stay in a luxurious hotel for a discounted rate

- Take advantage of birthday deals at your local gym

- Enjoy a free cupcake at a trendy coffee shop

- Explore your city with a free guided tour

- Receive exclusive discounts on birthday flowers and gifts

- Indulge in a free spa treatment or massage

- Get a free bottle of wine or cocktail at a fancy bar

- Save on admission to museums and attractions

- Take a free class or workshop

- Receive discounts on car rentals for your birthday road trip

- Try out a new activity like paddleboarding or rock climbing

- Get a free ticket to a concert or live event

- Enjoy free entry to a theme park or water park

- Receive discounts on personalized birthday gifts

- Get a free cake or dessert from a local bakery

- Save on clothing and accessories at second-hand shops

- Enjoy a free meal at a new restaurant in town

- Receive discounts on spa services and beauty treatments

- Get a free drink or appetizer at a popular bar or pub

- Save on admission to zoos and wildlife parks

- Take advantage of birthday discounts at health and wellness stores

- Get a free gift from your favorite bookshop

- Enjoy a discounted stay at a luxury resort or hotel

- Receive exclusive discounts on birthday party supplies

- Indulge in a free dessert or sweet treat at a local ice cream shop

- Save on outdoor activities like zip-lining or kayaking

- Get a free birthday gift from your favorite clothing store

- Enjoy a discounted meal at a popular restaurant chain

- Receive discounts on personalized birthday party invitations

- Get a free haircut or style at a top salon

- Save on admission to amusement parks and arcades

- Take advantage of birthday deals at your local swimming pool

These 36 birthday freebies and discounts can help you celebrate your special day without spending a fortune. From free meals to discounted hotel stays, there are plenty of options to choose from. Just sign up for loyalty programs or birthday clubs at your favorite stores and establishments to start receiving these exclusive offers. Remember to check the terms and conditions, as some discounts may have restrictions or expiration dates. Enjoy your birthday and save money at the same time!

One in seven families miss an essential payment in a single month

According to the latest statistics, one in seven families in the UK misses an essential payment in a single month. This alarming number highlights the importance of creating a family budget and being in control of your finances.

Checking your bank balance regularly is essential to stay on track with your monthly spending. With the availability of online banking and mobile apps, it has become easier than ever to keep an eye on your finances. Make it a habit to check your balance at least once a week to ensure accuracy.

Budgeting involves looking at all your expenses and income-related factors. This means listing down all your sources of income, such as salary, pension, and any other additional income streams. On the expense side, you should include everything from household bills to loans, health-related expenses, entertainment, and even the occasional treat for yourself or your children.

It’s also important to define your financial goals and determine how much you can afford to save or invest each month. Prioritize your expenses accordingly and make sure you meet all essential payments, such as rent or mortgage, utilities, and groceries.

When it comes to shopping for groceries and other household items, consider using supermarket apps and loyalty cards to take advantage of discounts and special offers. Plan your meals for the week and buy in bulk whenever possible to save money. Additionally, don’t be afraid to haggle or look for freebies which can help reduce your expenses.

Another opportunity to save money is by cutting down on unnecessary expenses. For example, consider whether you really need to buy that new gadget or go on a lavish vacation. You can also save on entertainment by opting for free or low-cost activities such as hiking, picnics, or visiting local parks. Look for discounts on tickets and consider loyalty programs offered by entertainment companies.

If you have debts, it’s crucial to work towards paying them off as soon as possible. This may mean making minimum payments on multiple loans or credit cards, but it’s important to prioritize and have a plan to gradually reduce your debts.

Gifts can often be a significant expense, especially during holidays and special occasions. Consider setting a budget for gifts and be creative in finding affordable yet thoughtful options. Remember, it’s the sentiment behind the gift that matters most, not the price tag.

Throughout this budgeting process, it’s important to involve your whole family. This helps create a sense of responsibility and understanding of the importance of financial control. Teaching your children about money management from an early age can set them up for a financially healthy future.

Being in control of your finances not only helps you achieve financial comfort but also strengthens your relationship with money. It gives you the freedom to make choices and pursue your goals without constantly worrying about money. So, take the time to create a family budget and gain a grip on your financial well-being.

| Source: | According to a study by the University of Wolverhampton in Wales |

| Source: | inspop.com |

20 ways to save money on your household bills and living costs in 2023

Managing your household bills and living costs can sometimes be a daunting task, especially if you’re on a tight budget. However, with some careful planning and a few savvy tips, you can significantly reduce your expenses and save money. Here are 20 ways to help you do just that:

- Estimates and comparisons: When choosing a service provider or making a purchase, gather estimates or compare prices to find the best deal.

- Budget for bills: Create a budget specifically for bills and allocate a certain amount each month to cover them.

- Manage energy usage: Turn off lights and appliances when not in use, unplug chargers, and use energy-efficient bulbs to reduce your energy bills.

- Reduce water consumption: Fix leaks, take shorter showers, and use water-saving devices to lower your water bill.

- Optimize your transport: Consider using public transportation, carpooling, or biking instead of driving alone to save on fuel and parking expenses.

- Refinance your mortgage: If possible, explore refinancing options to lower your monthly mortgage payments.

- Be conscious of food costs: Plan meals ahead, avoid eating out frequently, and buy in bulk to avoid unnecessary expenses on food.

- Shop strategically: Compare prices, use coupons or discounts, and buy second-hand items to save money on clothing, furniture, and other household necessities.

- Unsubscribe from unnecessary services: Review your subscriptions and cancel any that you no longer use or need.

- Reduce entertainment expenses: Look for free or low-cost activities, utilize libraries for books and movies, and be selective with paid entertainment options.

- Minimize bank and credit card fees: Choose accounts and cards with lower fees, avoid unnecessary ATM withdrawals, and pay bills on time to avoid late charges.

- Lower insurance costs: Compare insurance policies, bundle different insurances, and ask for discounts to lower your insurance premiums.

- Save on home maintenance: Regularly maintain your home and appliances to prevent expensive repairs in the future.

- Reduce healthcare expenses: Utilize generic medications, avoid unnecessary medical treatments, and stay proactive in maintaining good health.

- Save on communication costs: Assess your phone and internet plans, look for cheaper alternatives, and consider bundling services.

- Join a savings group: Team up with like-minded individuals to pool resources, share expenses, and collectively save money.

- Use less paper: Go digital whenever possible, opting for online statements, bills, and receipts.

- Set savings goals: Determine short-term and long-term savings goals to stay motivated and focused on reducing expenses.

- Stay informed: Sign up for a newsletter or follow reliable sources to stay updated on money-saving tips, deals, and opportunities.

- Teach your teens: Involve your teenagers in budgeting and educate them on the importance of saving money.

By implementing these strategies, you can substantially decrease your household bills and living costs, allowing you to meet your financial goals and have more money left in your wallet at the end of each month.

Which supermarket offers the best Christmas savings scheme

When it comes to the festive season, one step that many families take to avoid overspending is to plan ahead and set a budget for Christmas expenses. One way to do this is by taking advantage of a Christmas savings scheme provided by supermarkets. These savings schemes allow customers to save money throughout the year, and in return, they receive a bonus or incentive to use towards their Christmas shopping.

Qualifying for a Christmas savings scheme is easy. Customers simply need to sign up for the scheme and sometimes make regular deposits into a savings account specifically for Christmas. By doing so, they can enjoy the benefits and savings that come with it.

Supermarkets like InsPOPcom, Moses, and Confused.com offer Christmas savings schemes that have been a great hit with customers. These schemes have helped many families boost their budget and have a more enjoyable Christmas season.

One company that offers a particularly unique and personalized version of the Christmas savings scheme is Love2Save. Love2Save allows customers to set their own savings goals and provides a personalized budget worksheet to keep track of savings. This means that customers can estimate their Christmas savings and plan their spending accordingly.

Another supermarket that offers a Christmas savings scheme is Save-A-Lot. Save-A-Lot’s scheme is perfect for those who want to save a little each month without feeling overwhelmed. Customers can set their savings target and choose either a weekly or monthly deposit option.

Many supermarkets provide a range of savings schemes that cater to different needs and preferences. Some schemes offer bonuses or incentives in the form of gift cards, while others provide additional discounts or exclusive offers.

For those who want an alternative to supermarket savings schemes, there are also online platforms like InsPOPcom and Confused.com that offer Christmas savings accounts. These accounts function in a similar way to traditional supermarket savings schemes but give customers more flexibility and control over their savings.

In conclusion, finding the best Christmas savings scheme for your family requires a bit of research and consideration. However, the victories of having extra funds for Christmas shopping and avoiding overspending are well worth it. Whether you choose a supermarket savings scheme or an online alternative, the key is to start planning early and stick to your budget.

Which shops offer the best value for money on lunchtime meal deals

When it comes to saving money on lunchtime meals, finding shops that offer good value for money is essential. With so many options available, it can be difficult to know which ones are worth your time and money. However, by seeking out the best deals and making smart choices, you can stretch your budget and still enjoy a delicious meal.

One of the shops that consistently offers great value for lunchtime meals is Pure. They have a variety of healthy and affordable options to choose from, including salads, wraps, and soups. The quality of their food is top-notch, and their prices are reasonable. Whether you’re looking for a light lunch or something more filling, Pure is a great choice.

Another shop that’s worth considering is M&S. They offer a range of delicious sandwiches, wraps, and salads that are perfect for a quick lunch. The quality of their ingredients is high, and their prices are competitive. M&S is a great option for those who want a tasty lunch without breaking the bank.

If you’re looking for a wider variety of options, Tesco and Sainsbury’s are both worth checking out. They have a range of meal deal options that include sandwiches, snacks, and drinks for a set price. While the quality may not be as high as some other shops, the variety and value for money make them popular choices for lunchtime meals.

For those who prefer a hot meal, Greggs is a good option. They offer a range of hot food, including pasties, soups, and hot sandwiches, at a reasonable price. The quality and taste of their food are consistently good, making them a popular choice for a filling lunch.

When it comes to saving money on lunchtime meals, it’s important to remember that small changes can make a big difference. Choosing a shop that offers reusable containers, for example, can help reduce waste and save you money in the long run. Similarly, seeking out shops that offer loyalty programs or discount codes can help you save even more on your meals.